Basic candlestick types

As discussed in Cooking Tools #3, a candlestick is one way of representing the high, low, opening, and closing prices during a specified time period. The candlestick is composed of a body which is defined by the opening and closing prices and a shadow, wick, or tail (all three terms are used by chartologists) which extends from the body to the high and to the low prices for that time period. (See Cooking Tools #3 for a breakdown diagram of a candlestick.) If the price closes higher than the open, the body is traditionally colored in white (some folks like me prefer green) and represents a situation where there are more buyers than sellers. On the other hand, a black (or red) body signals that the price closed below the open and indicates more sellers than buyers. To a large extent, candlesticks are a measure of market sentiment which is how they are interpreted and why they are so useful. What a candlestick doesn't tell you is what the price action was like in the interim--something to keep in mind especially if you're looking at candlesticks marking larger time frames.

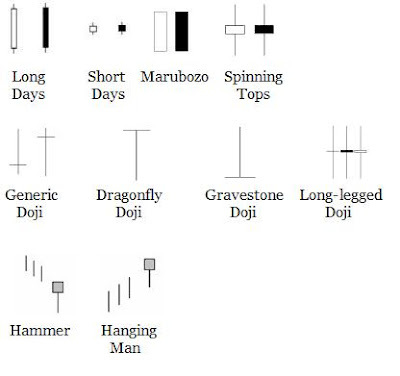

Here are the major single candlestick formations. (Note that the bodies can be either black or white.):

Long Day/Short Day: A long day shows a large price movement from the open to the close, and conversely for a short day.

Marubozo: This is a candlestick with a bald head, meaning there's no wicks on either end. This signals that the open and the close represent the high and the low of the day respectively showing conviction in price.

Spinning Tops: These signal indecision marked by have small bodies and long wicks. They are generally more meaningful as part of more complex patterns.

Doji: Doji (the plural of doji is doji) form when the price closes at or very near the opening price signalling a tug of war between the bulls and the bears. Doji are important candlestick types which are typically found in market reversal patterns. Different types of doji signal different market conditions.

Dragonfly: The opening and closing prices occur at the high of the day.

Gravestone: The opening and closing prices occur at the low of the day.

Long-legged: The open and closing prices occur near the middle of long wicks.

Umbrellas: Umbrella formations include hammers and hanging men and are also used to identify market tops and bottoms. (See Cooking Tools #3.) An umbrella consists of a narrow body usually with little or no upper wick but with a long lower wick. When an umbrella forms at the bottom of an extended decline, it's called a hammer; if it forms at the top of an advance, it's called a hanging man. Both formations signal a reversal in price movement.

No comments:

Post a Comment