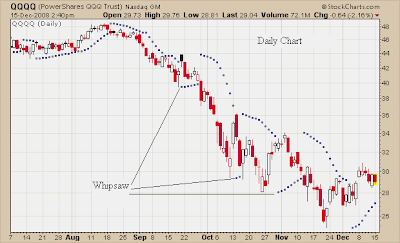

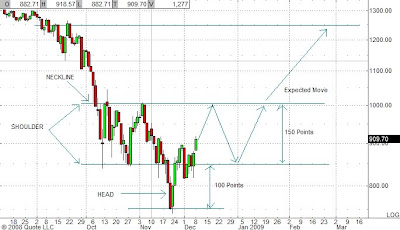

Today's market action indicates that we may be putting in a bottom, but whether this is THE BOTTOM or just a relative bottom remains to be seen. Personally, I don't think we've hit the bottom bottom as I feel we need to see the VIX rise a lot more (to 100?) before I'll be reassured that the worst is over. I still think hedge fund redemptions will continue until the end of the year. Why? Because investors will most likely want to take their tax losses in this year.* But in case I'm wrong and the indices are able to stay perched above current support levels, you need to have your list ready pronto so that you can lock in these low prices.

My blog for the past couple of weeks has been focused on income generating securities such as high dividend paying stocks and master limited partnerships (MLPs). Yesterday, we found that although MLPs trade exactly like stocks, they are structured differently as limited partnerships and not as corporations. This type of structuring avoids corporate taxation which is great on one hand because it allows a larger distribution (dividend) to be passed through to the unitholder (shareholder). On the other hand, the unitholder is ultimately responsible for the taxes which can become a complicated task at tax time.

Despite the tax complications, MLPs can be great additions to an investment portfolio (be careful of putting these in an IRA), especially if you have a long investment horizon. Today, we'll be sleuthing the space in search of beaten-down bargains.

My MLPs

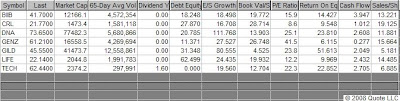

There are a few important things to look for in an MLP. You want to find a company that is expanding operations, has enough cash on its balance sheet to pay dividends, and has a steady history of increasing dividends. I ran a screen through the MSN MoneyCentral stock screener using current dividend yield > 5, 5-year dividend growth > 5, average daily volume > 50,000 (to avoid liquidity issues), and with an analyst mean recommendation >= Hold (we don't want any perceived dogs). Here are the results (see the table at the bottom for a summary of current prices and distribution yields):

Oil & Gas PipelinesGenesis Energy (GEL). The company beat recent third quarter estimates by 25%, earning 25 cents per share instead of the anticipated 20 cents. The company's CEO, Grant Sims, says that the company has more than enough cash to pay out distributions, with a cash/distribution payout ratio of 1.7 (that's pretty good). Further reassuring unit holders, he goes on to say that “the underlying cash flows from our businesses are not materially impacted by commodity prices and demand for our services appears to be steady. Genesis is fortunate to have approximately $170 million in available cash and debt commitments. This financial flexibility and high coverage of our distributions will be more than adequate to fund the internal accretive capital projects planned for the coming year and give us the ability to be opportunistic to hopefully continue to build long-term value for our unitholders.”

The stock hit a low of $8 on October 10th (the day of the grand market low) and is now trading at $9.42. If you like this one, now would be a good time to begin locking in that juicy 13% distribution yield.

Sunoco Logistics Partners (SXL). Despite losing revenue due to hurricane disruptions, the company is still increasing its distribution. It's also making new acquisitions and sports a fairly solid balance sheet. President and CEO Deborah Fretz is upbeat about the company's future: “Despite the turmoil in the credit markets, our business model remains solid and transparent and our strong financial position supports future growth. We announced a cash distribution of $0.965, a 3.2% increase versus last quarter and a 13.5% increase versus the third quarter 2007. It is the twenty-first distribution increase in the last twenty-two quarters. As announced last quarter, we expect to increase our 2009 distribution by at least 10% and we reaffirm this guidance given the investment opportunities we have underway."

Sunoco is currently trading around $43, and I'd grab some of this before it rises any further.

Magellan Midstream Partners (MMP). The company has healthy expansion prospects which are being funded by a $550M revolving line of credit with 18 banks, of which it has only used $15M. "We faced several challenges during the quarter, but our positive results show that our commodity-related activities continued to serve as a natural hedge against the negative impact of high refined products prices on demand for transportation services," said Don Wellendorf, chief executive officer. "The large majority of our operating margin continues to come from historically stable fee-based services, and we have an extremely strong balance sheet to fund growth opportunities."

This security is in a bit of a downturn. If you can pick some up around $25, you'd be stealing it.

Plains All American Pipeline (PAA). The company beat third quarter estimates with the CEO, Greg Armstrong, painting a rosy forecast: "We continue to see strong demand for our assets and services within each of our three segments, and we are pleased with PAA's positioning relative to the current state of the financial markets. We have a solid balance sheet, ample liquidity and are well positioned to execute our growth plans for the remainder of 2008 and the full year of 2009 without the need to access the capital markets."

The security is a good buy at current levels of $34; even better if you can get it around $30.

Kinder Morgan Energy Partners (KMP). This company keeps coming up on all of the high-dividend stock screens. Many Wall Street know-it-alls also like it—what can I say? It is the King Kong of the pipeline MLPs. I haven't seen any news to knock it, but I haven't seen any news that makes me want to love it, either. It's trading around $50; if it was five bucks cheaper I'd like it a lot more.

Nustar Energy (NS). Not only is Nustar an energy play, but with its asphalt refining capabilities, it's also an infrastructure play. It's two two two plays in one!

“While we expect earnings for the fourth quarter of 2008 to be down significantly from the third quarter primarily due to the seasonality of the asphalt operations, the full year of 2008 should be a record year with the highest annual earnings in the partnership’s history. Longer-term, we expect that asphalt supply markets will continue to tighten and margins will increase as the refinery coker units come online. And, although we have identified approximately $500 million of high-return internal growth projects that could be completed over the next two to three years, we have scaled back our budgeted strategic and reliability capital expenditures in 2009 to approximately $150 million in light of the current capital markets environment,” said Curt Anastasio, Nustar's CEO.

The security would have been a good buy at $41 when it traded near its low today. Try to catch it under $45.

Buckeye Partners (BPL). Company revenues are increasing as well as its distribution. The company hasn't missed a distribution payment in over 21 years. Forrest Wylie, CEO, maintains a positive operating outlook: "In connection with the current credit crisis, I would like to emphasize that Buckeye is in the favorable position of having a strong balance sheet that allows us to fund our current slate of internal growth projects with cash flow from operations and debt rather than equity. We have sufficient borrowing capacity available to us under our $600 million revolving credit facility. Our conservative approach to risk and credit metrics has put us in a good position in these times of tightening credit markets."

Anywhere at this level ($36) is a good buy.

Atlas Pipeline (APL) also showed up on the screener but it's a much riskier choice than the others. John Tysseland, an analyst at Citi, cut his ratings from Buy to Sell on the company last month citing increasing risk to Atlas unitholders. "Simply stated, as the price of crude continues to weaken the risks to Atlas Pipeline unitholders continue to mount," Tysseland said in a note to clients. “Atlas may have to cut its distribution if crude prices stay at current levels, and if they average below $60 a barrel for an extended period of time the company could violate its debt covenants,” he said.

The stock is trading at record lows and showed some price firming in today's strong market close. If you think that oil has found a bottom, you might want to dip your toe into the Atlas waters. It's distribution yield is 31%, but I wouldn't count on that lasting for too long.

Other popular picksFor the sake of completeness, I thought I'd include other MLPs (not necessarily oil & gas pipeline companies) that many Wall Streeter's have been touting: Terra Nitrogen (TNH), Energy Transfer Partners (ETP), Enbridge Energy (EEP), and ONEOK Partners (OKS).

SummaryI only covered the oil & gas pipeline companies today but there are many more in the MLP space. Tomorrow I'll conclude the series with a quick look at the best of the rest. Despite today's end-of-day monster rally, that doesn't mean we're out of the woods. In that regard, I'd strongly suggest tempering your buying by spreading it out, meaning buy a fractional position today, another in a few more days, etc. You may end up paying more but then again, you may end up paying less. And I don't want you any unhappy campers out there.

Another Good ResourceI just found this article today. It provides further insight into MLPs and is written by one of my favorite financial writers, Michael Brush. (I like those MSN Money guys!)

Make your money grow 7% to 12%, by Michael Brush. MSN MoneyCentral. 9/3/08

*Watch for stock proxies in the form of options to make up the shortfall. What this means is that if an investor wants to take a loss in a certain sector, say the financials, she might sell those stocks this year to claim the tax loss while simultaneously buying options in the same sector to cash in on her positions just in case the sector rallies. Next year (and after 30 days), she can then sell the options and repurchase her stocks without tax consequences.