I had an appointment this morning and just got back in so I won't have time to post my usual insightful and provocatively written blog. I was going to skip it today but in doing my usual morning search for possible additions to the MANDA Fund--my M&A post-takeover announcement fund (see July 18 blog)--I stumbled upon a nifty resource on the Reuters news site: a daily newsletter detailing the latest M&A activity (including IPOs) that's emailed to your inbox before 8am ET. How cool is that? It'll sure save me a bunch of time in the morning. But this newsletter is just one of nine others that are free for the asking. I also signed up for the technology report. the health report, the Morning Digest, and my favorite--the Oddly Enough report that contains “quirky, strange-but-true stories from everywhere.” I could use a good grin with my morning cuppa joe.

That's my tip for the day. I'm always grateful for anything that makes my day go more smoothly and I admit that it's the little things in life that give me the most pleasure...although I certainly wouldn't be upset if I won the lottery.

Disclaimer: I have no personal or professional affiliation with Reuters nor do any of my colleagues, friends, or family (that I know of).

To sign up for any of the Reuters newsletters, go to https://commerce.us.reuters.com/profile/pages/newsletter/begin.do

Thursday, July 31, 2008

Wednesday, July 30, 2008

Cooking Tools #7: Fibonacci Support & Resistance Levels

I've mentioned in blogs of days past about Fibonacci ratios and how they are used by market technicians and traders to determine support and resistance levels, but I never defined them. Seeing as how popular they are and how they really do reflect price movement, I thought I'd provide a short overview of the subject so that you'll know what they are when people mention them.

What is a Fibonacci number?

The famous Fibonacci number sequence was named for an Italian mathematician, Leonardo di Pisa--aka Fibonacci, who wrote about the number sequence (although he did not invent it) as well as introducing the Arabic number system to Europe in his 13th century bestseller, Liber Abaci, known in English as the Book of Calculation. Eight hundred years later, Dan Brown also used Fibonacci numbers as an integral part of his bestseller, The Davinci Code. If you're one of the few people on the planet who hasn't read this book, let me explain Fibonacci numbers. They are nothing but the sequence: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233... where each successive number is formed by the addition of the previous two numbers. The golden mean or golden ratio, is an approximation formed by the ratio of two adjacent numbers in the sequence. The larger the numbers, the better the approximation. For example, 5/8 = 0.625, but 144/233 = 0.6180 which is a much better approximation to the golden mean. (233/144 = 1.6180 is also called the golden mean, FYI.)

Why are they significant?

The golden mean has significance in many areas of art and science, and it also plays a prominent role in stock chart analysis. But the 61.8% level is not the only level of significance--levels formed by other ratios provided insight into trading psychology, too. These other levels are determined by the ratio of two Fibonacci numbers separated by one, two, or three numbers. For example, the next important Fibonacci level is given by 89/233 = 0.382 or the 38.2% level. Of lesser importance is the next level, given by 55/233 = 0.236 or the 23.6% level. You should note that although the 50% retracement level is not a Fibonacci level (I know it can be derived from 1/2 but from no other Fibonacci numbers) it is considered to be an important psychological trading level and so technicians include it in their analysis.

What these Fibonacci levels do is provide a clue as to intermediate levels of price support and resistance between two extremes. To find these levels, subtract the vertical distance between two extreme points and divide that by the key Fibonacci ratios of 23.6% (0.236), 38.2% (0.382), 50% (o.50), and 61.8% (0.618). Note that Fibonnaci levels aren't always exact but they do provide decent ballpark numbers. The figure below is a recent chart of the S&P along with key Fibonacci levels.

Conclusion

Many charting programs include Fibonacci ratios in the form of retracement levels, arcs, and fans. Note that the strength of a level intensifies with each price test so that when the level is finally broken, the price movement will be particularly strong and trades made on that breakout generally have a much better chance of success.

As with other indicators, Fibonacci ratios aren't always accurate, so use them as a guide to your trading rather than as an overall trading strategy. They are particularly useful in placing stop-losses or setting price targets. Some traders use pullbacks to Fibonacci levels to add to existing positions. Fibonacci ratios are also used in Elliott Wave Theory, Gann retracement levels, and in Gartley Patterns.

What is a Fibonacci number?

The famous Fibonacci number sequence was named for an Italian mathematician, Leonardo di Pisa--aka Fibonacci, who wrote about the number sequence (although he did not invent it) as well as introducing the Arabic number system to Europe in his 13th century bestseller, Liber Abaci, known in English as the Book of Calculation. Eight hundred years later, Dan Brown also used Fibonacci numbers as an integral part of his bestseller, The Davinci Code. If you're one of the few people on the planet who hasn't read this book, let me explain Fibonacci numbers. They are nothing but the sequence: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233... where each successive number is formed by the addition of the previous two numbers. The golden mean or golden ratio, is an approximation formed by the ratio of two adjacent numbers in the sequence. The larger the numbers, the better the approximation. For example, 5/8 = 0.625, but 144/233 = 0.6180 which is a much better approximation to the golden mean. (233/144 = 1.6180 is also called the golden mean, FYI.)

Why are they significant?

The golden mean has significance in many areas of art and science, and it also plays a prominent role in stock chart analysis. But the 61.8% level is not the only level of significance--levels formed by other ratios provided insight into trading psychology, too. These other levels are determined by the ratio of two Fibonacci numbers separated by one, two, or three numbers. For example, the next important Fibonacci level is given by 89/233 = 0.382 or the 38.2% level. Of lesser importance is the next level, given by 55/233 = 0.236 or the 23.6% level. You should note that although the 50% retracement level is not a Fibonacci level (I know it can be derived from 1/2 but from no other Fibonacci numbers) it is considered to be an important psychological trading level and so technicians include it in their analysis.

What these Fibonacci levels do is provide a clue as to intermediate levels of price support and resistance between two extremes. To find these levels, subtract the vertical distance between two extreme points and divide that by the key Fibonacci ratios of 23.6% (0.236), 38.2% (0.382), 50% (o.50), and 61.8% (0.618). Note that Fibonnaci levels aren't always exact but they do provide decent ballpark numbers. The figure below is a recent chart of the S&P along with key Fibonacci levels.

Conclusion

Many charting programs include Fibonacci ratios in the form of retracement levels, arcs, and fans. Note that the strength of a level intensifies with each price test so that when the level is finally broken, the price movement will be particularly strong and trades made on that breakout generally have a much better chance of success.

As with other indicators, Fibonacci ratios aren't always accurate, so use them as a guide to your trading rather than as an overall trading strategy. They are particularly useful in placing stop-losses or setting price targets. Some traders use pullbacks to Fibonacci levels to add to existing positions. Fibonacci ratios are also used in Elliott Wave Theory, Gann retracement levels, and in Gartley Patterns.

Tuesday, July 29, 2008

Stop It!: Stop-Loss Results for Bearish Scenarios

In the May 27th blog we looked at different types of common stop-loss strategies and discussed when and how to use them. In the June 13 blog we looked at stop-loss results for bullish scenarios and found that absolute stops on the order of 5-15% fared better most of the time compared with trailing stops and the ratchet stop fared the best overall but sometimes at the expense of a higher drawdown. Although it wasn't noted at the time, the cases with no stop-losses did surprising well with average drawdown. Will this be the case with the shorts? Let's find out.

The Set-Up

The set-up this time was similar to the long scenarios, the exception being that I only used 5 stocks for my short portfolios instead of 10. The reason for this is that I've found that there's far fewer choice candidates on the short side. What I did was to look at three different portfolios of 5 stocks each--one composed of stocks priced between $5- $10, one composed of stocks priced between $10 and $30, and the other of stocks priced between $30 and $100. My simulation consisted of finding stocks breaking to new 250 day lows, which is a good strategy in a bear market. If more than 5 candidates showed up, an extra “ickiness” factor was added as a sorting technique. I ran my simulations at two different times when the market was in a downtrend, from 3/19/02 to 7/24/02, and from 11/01/07 to 3/17/08. (Simulation and account information are summarized at the end of the article.*)

The following stops were used: Trailing stops between 5%-50%, Gain/Loss stops with Gains set at 1000% (literally no stop on the gain side) and losses varying from 5%-25%, a ratchet stop, and finally, no stop at all. The following table shows the results. The first row of each simulation shows the profit or loss over the time period. The second row is the number of stocks traded each of which involves two trades, a sell and a buy. The win/loss percentage is in the third row followed by the maximum portfolio draw-down.

Results summary

As I said before, two scenarios don't make for highly accurate statistics but we can note certain trends. The most interesting and certainly not the most expected result is that the best stop-loss seems to be no stop-loss at all! Not only does it post decent returns, but with the least number of trades, the highest win/loss ratio, and lower drawdowns. I was shocked! The next best stop-loss systems are the 25% loss and the ratchet stop. Although the trailing stops did well in the 2002 cases, they did so at the expense of significantly more trades and larger drawdowns. In the 2007-2008 cases, they underperformed the other strategies except for the low priced stocks.

Comparing Bull & Bear market scenarios

If you compare the June 12th bull market table with the bear market one above, you'll see some interesting differences between trading in these two environments. It's a market maxim that trading in bear markets can be more profitable but it's a riskier endeavor. This is clearly evident in the tables where, in the bull market cases, the maximum profit over all scenarios is 73% and the greatest drawdown is 24% whereas in bear markets, the maximum profit is 191% but the maximum drawdown is a gut-wrenching 60%. (All scenarios are on the order of 3-5 months.) The table below compares the average profits and drawdowns for all the bull and bear scenarios as well as for the no stop-loss case. (Note that the numbers below reflect 50% margin accounts.) It's no wonder many people are adverse to shorting stocks!

Conclusion

I guess the moral of the story is that to get the most bang for your shorting buck, setting no stop-loss is the way to go, but you've got to be able to swallow the draw-downs. If you can't stomach that, don't think about shorting--just stay in cash or cash equivalents and take a long vacation. As in gambling, the real trick is to know when to fold 'em. Hindsight is indeed 20-20, but when should you finally cover your positions? The answer is: When the bear market is over. (Don't hit me!) Look at other indicators, especially the VIX, and if that moves below 20 and stays there for several days, I'd go ahead and cover my positions. But I don't think that time is now or anytime soon.

Now you have the long and the short on stop-losses. Use them...or not!

*Simulation Conditions & Parameters: $9.95 commissions. 2% account interest; 3.5% margin interest. All portfolios were algorithmically selected (meaning that I didn't hand pick them, thank the Lord!) according to set parameters. When a stock hit its stop-loss, it was covered. A new search was run and the stock that came to the top of the list was then selected for shorting. All trades were executed at the market-on-close price. Trade sizes reflected a fixed, equal percentage of the current cash in the account. Profit/loss percentages are the result of using 50% margin on all trades (long and short included).

The Set-Up

The set-up this time was similar to the long scenarios, the exception being that I only used 5 stocks for my short portfolios instead of 10. The reason for this is that I've found that there's far fewer choice candidates on the short side. What I did was to look at three different portfolios of 5 stocks each--one composed of stocks priced between $5- $10, one composed of stocks priced between $10 and $30, and the other of stocks priced between $30 and $100. My simulation consisted of finding stocks breaking to new 250 day lows, which is a good strategy in a bear market. If more than 5 candidates showed up, an extra “ickiness” factor was added as a sorting technique. I ran my simulations at two different times when the market was in a downtrend, from 3/19/02 to 7/24/02, and from 11/01/07 to 3/17/08. (Simulation and account information are summarized at the end of the article.*)

The following stops were used: Trailing stops between 5%-50%, Gain/Loss stops with Gains set at 1000% (literally no stop on the gain side) and losses varying from 5%-25%, a ratchet stop, and finally, no stop at all. The following table shows the results. The first row of each simulation shows the profit or loss over the time period. The second row is the number of stocks traded each of which involves two trades, a sell and a buy. The win/loss percentage is in the third row followed by the maximum portfolio draw-down.

Results summary

As I said before, two scenarios don't make for highly accurate statistics but we can note certain trends. The most interesting and certainly not the most expected result is that the best stop-loss seems to be no stop-loss at all! Not only does it post decent returns, but with the least number of trades, the highest win/loss ratio, and lower drawdowns. I was shocked! The next best stop-loss systems are the 25% loss and the ratchet stop. Although the trailing stops did well in the 2002 cases, they did so at the expense of significantly more trades and larger drawdowns. In the 2007-2008 cases, they underperformed the other strategies except for the low priced stocks.

Comparing Bull & Bear market scenarios

If you compare the June 12th bull market table with the bear market one above, you'll see some interesting differences between trading in these two environments. It's a market maxim that trading in bear markets can be more profitable but it's a riskier endeavor. This is clearly evident in the tables where, in the bull market cases, the maximum profit over all scenarios is 73% and the greatest drawdown is 24% whereas in bear markets, the maximum profit is 191% but the maximum drawdown is a gut-wrenching 60%. (All scenarios are on the order of 3-5 months.) The table below compares the average profits and drawdowns for all the bull and bear scenarios as well as for the no stop-loss case. (Note that the numbers below reflect 50% margin accounts.) It's no wonder many people are adverse to shorting stocks!

Conclusion

I guess the moral of the story is that to get the most bang for your shorting buck, setting no stop-loss is the way to go, but you've got to be able to swallow the draw-downs. If you can't stomach that, don't think about shorting--just stay in cash or cash equivalents and take a long vacation. As in gambling, the real trick is to know when to fold 'em. Hindsight is indeed 20-20, but when should you finally cover your positions? The answer is: When the bear market is over. (Don't hit me!) Look at other indicators, especially the VIX, and if that moves below 20 and stays there for several days, I'd go ahead and cover my positions. But I don't think that time is now or anytime soon.

Now you have the long and the short on stop-losses. Use them...or not!

*Simulation Conditions & Parameters: $9.95 commissions. 2% account interest; 3.5% margin interest. All portfolios were algorithmically selected (meaning that I didn't hand pick them, thank the Lord!) according to set parameters. When a stock hit its stop-loss, it was covered. A new search was run and the stock that came to the top of the list was then selected for shorting. All trades were executed at the market-on-close price. Trade sizes reflected a fixed, equal percentage of the current cash in the account. Profit/loss percentages are the result of using 50% margin on all trades (long and short included).

Monday, July 28, 2008

Fi-Fie-Foe Financials

Due to technical difficulties as in my internet connection being unavailable for most of the trading session, I'm again forced to kluge together another blog that hopefully will be of some passing use and interest. In regards to last week's query, “Are we in a new bull market or is this rally just another bear trap?,” today's action should leave us with no question that the bear isn't about to go back into hibernation. All of the indices are heading to the outhouse with the financials leading the pack. It's been speculated that last week's rally in this sector was due in part to massive naked short covering that, by the way, will end tomorrow unless the SEC decides to extend the ban (which it should!). Most of the stocks affected by this short squeeze have already rolled over and their charts are not pretty. Not only do the charts look butt-ugly, but the news across the board looks pretty grim as well. It was reported today that credit card deliquencies are up sharply compared with a year ago which bodes even worse for the already ailing companies in this space: Visa (V), American Express (AXP), Citi (CIT), Discover (DFS), and MasterCard (MA). The best of the bunch by a country mile is MasterCard but even that has gotten a 20% haircut in the past couple of months.

Are there any good plays here?

There are a multitude of good plays--pick a stock and short it--but there are a few that are more compelling than the others.The risk adverse investor might want to take a gander at the SKF, the Ultra-Short Financial ETF. It's recovering from a recent low and is trading around $142. I'd hop on that train and ride it until the VIX trades above 30 (it's now at 24) and then jump off. The last time the VIX hit 30 (July 15th), the SKF was trading at $200, a 40% increase over today's close.

Next on the list is American Express, AXP. Since inception, this stock has been a steady eddy until last summer when the credit crisis began to unfold. Since then, the stock has dropped over 40% and has broken to a new five year low. The monthly chart view is very bearish and could be a great shorting opportunity down to the $30 level at least for a 14% return.

My final pick is market bellweather Merrill-Lynch, MER. It has the worst looking chart of the major financial institutions although Goldman-Sachs (GS), Lehman (LEH) and Morgan-Stanley (MS) are not far behind. Currently, Uncle Merrill is threatening to break an almost ten-year low put in a couple of weeks ago. Minor support is at $20; major support around $16.

No, folks, the fun in the financials is not over. The market is handing us a bunch of sour lemons so let's make some sweet lemonade. Drink up!

Are there any good plays here?

There are a multitude of good plays--pick a stock and short it--but there are a few that are more compelling than the others.The risk adverse investor might want to take a gander at the SKF, the Ultra-Short Financial ETF. It's recovering from a recent low and is trading around $142. I'd hop on that train and ride it until the VIX trades above 30 (it's now at 24) and then jump off. The last time the VIX hit 30 (July 15th), the SKF was trading at $200, a 40% increase over today's close.

Next on the list is American Express, AXP. Since inception, this stock has been a steady eddy until last summer when the credit crisis began to unfold. Since then, the stock has dropped over 40% and has broken to a new five year low. The monthly chart view is very bearish and could be a great shorting opportunity down to the $30 level at least for a 14% return.

My final pick is market bellweather Merrill-Lynch, MER. It has the worst looking chart of the major financial institutions although Goldman-Sachs (GS), Lehman (LEH) and Morgan-Stanley (MS) are not far behind. Currently, Uncle Merrill is threatening to break an almost ten-year low put in a couple of weeks ago. Minor support is at $20; major support around $16.

No, folks, the fun in the financials is not over. The market is handing us a bunch of sour lemons so let's make some sweet lemonade. Drink up!

Friday, July 25, 2008

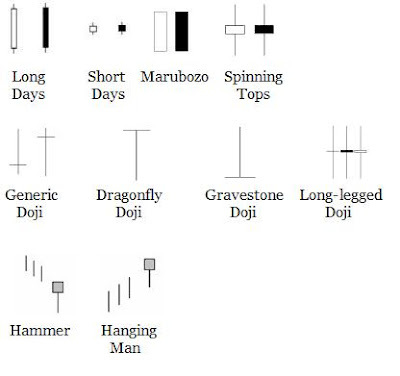

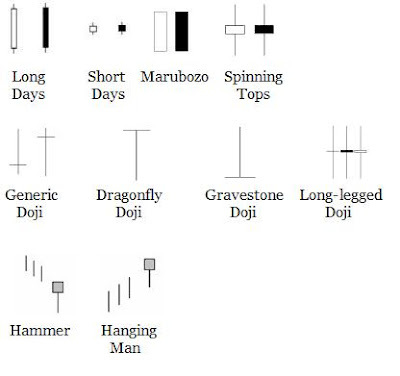

Cooking Tools #6: Introduction to Candlesticks

Cooking Tools #3 showed how candlestick formations can be used to determine reversals in price trends. What I really should have done first was to give a primer on basic candlestick formations which would provide you, dear reader, with the building blocks for the more complex patterns I'll be detailing and referring to in the near future. Candlesticks are extremely useful tools in technical analysis and with proper application, they can make a significant difference in your trading success. So, if you're unfamiliar with them, this is a great place to start. There are many other worthwhile candlestick resources, both online and in book form, and I strongly encourage you to peruse them for further information.

Basic candlestick types

As discussed in Cooking Tools #3, a candlestick is one way of representing the high, low, opening, and closing prices during a specified time period. The candlestick is composed of a body which is defined by the opening and closing prices and a shadow, wick, or tail (all three terms are used by chartologists) which extends from the body to the high and to the low prices for that time period. (See Cooking Tools #3 for a breakdown diagram of a candlestick.) If the price closes higher than the open, the body is traditionally colored in white (some folks like me prefer green) and represents a situation where there are more buyers than sellers. On the other hand, a black (or red) body signals that the price closed below the open and indicates more sellers than buyers. To a large extent, candlesticks are a measure of market sentiment which is how they are interpreted and why they are so useful. What a candlestick doesn't tell you is what the price action was like in the interim--something to keep in mind especially if you're looking at candlesticks marking larger time frames.

Here are the major single candlestick formations. (Note that the bodies can be either black or white.):

Long Day/Short Day: A long day shows a large price movement from the open to the close, and conversely for a short day.

Marubozo: This is a candlestick with a bald head, meaning there's no wicks on either end. This signals that the open and the close represent the high and the low of the day respectively showing conviction in price.

Spinning Tops: These signal indecision marked by have small bodies and long wicks. They are generally more meaningful as part of more complex patterns.

Doji: Doji (the plural of doji is doji) form when the price closes at or very near the opening price signalling a tug of war between the bulls and the bears. Doji are important candlestick types which are typically found in market reversal patterns. Different types of doji signal different market conditions.

Dragonfly: The opening and closing prices occur at the high of the day.

Gravestone: The opening and closing prices occur at the low of the day.

Long-legged: The open and closing prices occur near the middle of long wicks.

Umbrellas: Umbrella formations include hammers and hanging men and are also used to identify market tops and bottoms. (See Cooking Tools #3.) An umbrella consists of a narrow body usually with little or no upper wick but with a long lower wick. When an umbrella forms at the bottom of an extended decline, it's called a hammer; if it forms at the top of an advance, it's called a hanging man. Both formations signal a reversal in price movement.

Basic candlestick types

As discussed in Cooking Tools #3, a candlestick is one way of representing the high, low, opening, and closing prices during a specified time period. The candlestick is composed of a body which is defined by the opening and closing prices and a shadow, wick, or tail (all three terms are used by chartologists) which extends from the body to the high and to the low prices for that time period. (See Cooking Tools #3 for a breakdown diagram of a candlestick.) If the price closes higher than the open, the body is traditionally colored in white (some folks like me prefer green) and represents a situation where there are more buyers than sellers. On the other hand, a black (or red) body signals that the price closed below the open and indicates more sellers than buyers. To a large extent, candlesticks are a measure of market sentiment which is how they are interpreted and why they are so useful. What a candlestick doesn't tell you is what the price action was like in the interim--something to keep in mind especially if you're looking at candlesticks marking larger time frames.

Here are the major single candlestick formations. (Note that the bodies can be either black or white.):

Long Day/Short Day: A long day shows a large price movement from the open to the close, and conversely for a short day.

Marubozo: This is a candlestick with a bald head, meaning there's no wicks on either end. This signals that the open and the close represent the high and the low of the day respectively showing conviction in price.

Spinning Tops: These signal indecision marked by have small bodies and long wicks. They are generally more meaningful as part of more complex patterns.

Doji: Doji (the plural of doji is doji) form when the price closes at or very near the opening price signalling a tug of war between the bulls and the bears. Doji are important candlestick types which are typically found in market reversal patterns. Different types of doji signal different market conditions.

Dragonfly: The opening and closing prices occur at the high of the day.

Gravestone: The opening and closing prices occur at the low of the day.

Long-legged: The open and closing prices occur near the middle of long wicks.

Umbrellas: Umbrella formations include hammers and hanging men and are also used to identify market tops and bottoms. (See Cooking Tools #3.) An umbrella consists of a narrow body usually with little or no upper wick but with a long lower wick. When an umbrella forms at the bottom of an extended decline, it's called a hammer; if it forms at the top of an advance, it's called a hanging man. Both formations signal a reversal in price movement.

Thursday, July 24, 2008

Cooking Tools #5: Tick-Talk

Yes, I'm still bogged down in my stop-loss research. Since all of my lackeys are on vacation (haven't they heard of a staycation?), I've got to do it myself. Sigh. Anyway, I guess the candlesticks formed yesterday weren't lying. The market did go down today. Yay me for predicting it. Boo Mr. Market. I'll be watching to see if the VIX breaks above 25. If previous history is any indication, every time it has done that it has also risen above 30, and since the VIX and the market move inversely to each other, this has meant new relative lows for the major indices.

Now the VIX isn't the only indicator of market direction--there are other indicators used by traders such as the equity put/call ratio, the Arms Index (aka the Trin), and the Tick. Today I'm going to introduce the Tick for those of you unfamiliar with it.

What is the Tick and why should I care?

The Tick is nothing more than an indication of directional movement. You can look at the tick on individual stocks or on market indices. Since we're more interested in the markets right now, we'll be referring to the Tick on the S&P 500. Before decimalization, one tick represented the smallest increment in price, say 1/8 or 1/4 of a point. Nowadays, it reflects whether a stock is trading to the upside or the downside. The Tick on an index, however, is slightly different--it reflects the difference between the number of stocks that are trading on an uptick with those that are trading on a downtick. Clearly, if there's a lot of selling, the tick will be a negative number. In general, the majority of Tick values range between 1000 and +1000 on “normal” trading days, but it's those days when the Tick enters extreme levels that traders should take note of.

Tick extremes

Extreme values on the Tick range from around +2500 and above and from -2500 and under. When the Tick hits one of these extreme values, a market reversal is either imminent or will usually occur in the very near future (within a day or two). What the Tick can't tell us, unfortunately, is the extent of the reversal--it could last for months or only a few days. Compare the daily charts below of the S&P 500 with the Tick.

Conclusion

Now you have another tool to put in your arsenal of indicators. Note that by itself the Tick isn't perfect; it's best used in conjunction with other indicators. Not only can the Tick be used to predict daily price movement, it can also be used successfully as an intra-day indicator which daytraders might find useful. (When I was daytrading S&P futures, I used the Tick combined with the Trin, but I'll leave that discussion to another day.) Motto: The market won't tick you off if you take note the Tick!

Now the VIX isn't the only indicator of market direction--there are other indicators used by traders such as the equity put/call ratio, the Arms Index (aka the Trin), and the Tick. Today I'm going to introduce the Tick for those of you unfamiliar with it.

What is the Tick and why should I care?

The Tick is nothing more than an indication of directional movement. You can look at the tick on individual stocks or on market indices. Since we're more interested in the markets right now, we'll be referring to the Tick on the S&P 500. Before decimalization, one tick represented the smallest increment in price, say 1/8 or 1/4 of a point. Nowadays, it reflects whether a stock is trading to the upside or the downside. The Tick on an index, however, is slightly different--it reflects the difference between the number of stocks that are trading on an uptick with those that are trading on a downtick. Clearly, if there's a lot of selling, the tick will be a negative number. In general, the majority of Tick values range between 1000 and +1000 on “normal” trading days, but it's those days when the Tick enters extreme levels that traders should take note of.

Tick extremes

Extreme values on the Tick range from around +2500 and above and from -2500 and under. When the Tick hits one of these extreme values, a market reversal is either imminent or will usually occur in the very near future (within a day or two). What the Tick can't tell us, unfortunately, is the extent of the reversal--it could last for months or only a few days. Compare the daily charts below of the S&P 500 with the Tick.

Conclusion

Now you have another tool to put in your arsenal of indicators. Note that by itself the Tick isn't perfect; it's best used in conjunction with other indicators. Not only can the Tick be used to predict daily price movement, it can also be used successfully as an intra-day indicator which daytraders might find useful. (When I was daytrading S&P futures, I used the Tick combined with the Trin, but I'll leave that discussion to another day.) Motto: The market won't tick you off if you take note the Tick!

Wednesday, July 23, 2008

Market Reversal?

I'm still bogged down in research (grrr!) but am taking time out to toss in my two cents concerning today's market action. The major indices are all putting in what appears to be short-term tops. How can I tell? Because of their topping tails which are forming the likes of doji stars and shooting stars, both bearish candlestick formations. (See Cooking Tools #2.) The Regional Bank Holders (RKH) and the Financial Spider (XLF) are showing similar topping patterns. What does this mean? It means we'll likely see the markets turnaround tomorrow. Whether this is the start of a real bull run or another bear trap can't be determined as yet. I've said before that I and many others much more in the know still believe there's more unwinding left to do in the credit market and until the final shoe drops, I wouldn't be loading up on long positions especially in financials. I think some of the turnaround in this sector can be attributed to naked short covering coming on the heels of the SEC prohibiting the practice in some stocks with threats to extend it to the entire market. I do believe that patience here will be ultimately be rewarded.

I'll be back in full tomorrow. A bientot, mon ami.

I'll be back in full tomorrow. A bientot, mon ami.

Tuesday, July 22, 2008

Another MANDA Addition + Market Potpourri

I was hoping to post the results of my stop-loss analysis of shorts but there was another software snafu as typically happens when I really want to get something out so I'm hastily kluging together a short blog for today. Earlier this morning I picked up shares of Bluegreen Corporation (BXG) which has signed a non-binding letter of intent to be sold to Diamond Resorts International later this year. The $15 a share offer represents an 132% increase over yesterday's closing price of $6.44. None of the press releases mention if it's a cash-only offer but I'm assuming so since Diamond is privately held. Needless to say the Bluegreen board was thrilled with the magnanimous offer, and so was I since the $15 price represents a 25% increase over the $11.99 price at which I purchased the stock for the MANDA portfolio as well as my own privately managed one. (Both companies are in the vacation resort business.)

Market: Is it a Bull? Is it a Bear?

With the VIX spiking over 30 last week, a breather from the bear was in order. But will this recent rally last? On the bullish side, the VIX only two days ago broke its 20dma which provided solid support. It's now sitting at 22 and a break below 20 would be a signal to exit short positions. The Dow Transports, a leading indicator of market direction, handily broke overhead resistance today at 500. The other indices are following suit as they're all trading in the green. But the bears still have some roar left. Consider the Buy/Sell ratio (BSR). A value over 1.0 is considered bullish as there are more buyers than sellers (my apologies for the no-brainer). However, the BSR is still sitting in the basement at 0.21, although it's up from its 0.12 relative low last week. In my opinion, it has a long ways to go before I'll come out of hiberation.

A few market musings

Glancing at the new highs list today, I see that Finish Line (FINL), the athletic footwear retailer, is on it. In fact this stock has gained over 500% since this January! Could this be the start of a turnaround that was forecast for retail? (See blog on 2/13 for info on the retail sector.) Also making the list are Identix Pharmaceuticals (IDIX) and Cyberonics (CYBX), both in the rising healthcare sector, some of which we looked at in the July 8-10 blogs. Identix, a biotech specializing in viruses and infectious disease treatments, is trading just over $8--a rise of nearly 300% since last December. The stock didn't quite make it on my biotech buy list because at the time is was caught in a trading range. Yesterday it broke out of that range and is looking to make a run towards its next resistance at $8.50. I'll be very interested to see how it performs after it reports earnings before the bell next Tuesday. If investors like what they hear, it might be a good time to get in on it. Cyberonics makes treatment devices for epilepsy and depression (good news for the aching bulls!). Its stock has rocketed from under $10 in February to over $27. Apparently, it's doing something right because institutions have become heavy buyers in recent weeks. The stock has a tendency to bounce off its 20dma and I'd wait for it to come back to that level before I'd jump in. (In the $24-$25 range.)

That's about for today. One of my goals in writing this blog is to offer my readers something they can dig their teeth into--you know, something more than just exposition. Not that that doesn't have its place, but it's information that is available on hundreds of websites. So my apologies for coming up short today. But if the gods are smiling on me, I'll be able to publish the results of my stop-loss testing for short positions in tomorrow's blog. Same bat-time, same bat-channel!

Market: Is it a Bull? Is it a Bear?

With the VIX spiking over 30 last week, a breather from the bear was in order. But will this recent rally last? On the bullish side, the VIX only two days ago broke its 20dma which provided solid support. It's now sitting at 22 and a break below 20 would be a signal to exit short positions. The Dow Transports, a leading indicator of market direction, handily broke overhead resistance today at 500. The other indices are following suit as they're all trading in the green. But the bears still have some roar left. Consider the Buy/Sell ratio (BSR). A value over 1.0 is considered bullish as there are more buyers than sellers (my apologies for the no-brainer). However, the BSR is still sitting in the basement at 0.21, although it's up from its 0.12 relative low last week. In my opinion, it has a long ways to go before I'll come out of hiberation.

A few market musings

Glancing at the new highs list today, I see that Finish Line (FINL), the athletic footwear retailer, is on it. In fact this stock has gained over 500% since this January! Could this be the start of a turnaround that was forecast for retail? (See blog on 2/13 for info on the retail sector.) Also making the list are Identix Pharmaceuticals (IDIX) and Cyberonics (CYBX), both in the rising healthcare sector, some of which we looked at in the July 8-10 blogs. Identix, a biotech specializing in viruses and infectious disease treatments, is trading just over $8--a rise of nearly 300% since last December. The stock didn't quite make it on my biotech buy list because at the time is was caught in a trading range. Yesterday it broke out of that range and is looking to make a run towards its next resistance at $8.50. I'll be very interested to see how it performs after it reports earnings before the bell next Tuesday. If investors like what they hear, it might be a good time to get in on it. Cyberonics makes treatment devices for epilepsy and depression (good news for the aching bulls!). Its stock has rocketed from under $10 in February to over $27. Apparently, it's doing something right because institutions have become heavy buyers in recent weeks. The stock has a tendency to bounce off its 20dma and I'd wait for it to come back to that level before I'd jump in. (In the $24-$25 range.)

That's about for today. One of my goals in writing this blog is to offer my readers something they can dig their teeth into--you know, something more than just exposition. Not that that doesn't have its place, but it's information that is available on hundreds of websites. So my apologies for coming up short today. But if the gods are smiling on me, I'll be able to publish the results of my stop-loss testing for short positions in tomorrow's blog. Same bat-time, same bat-channel!

Monday, July 21, 2008

The Shocking Truth About Naked Shorting

While shooting the breeze the other day with Professor Pat, I asked him if he knew anything about naked short selling. He said no and I said great! Why don't you write an article about it? And so he did and here it is. It's a good read and trust me, you're not going to like the practice of naked shorting. The SEC should be ashamed of itself at allowing this clearly unfair--if not downright fraudulent--practice to occur and the brokerage firms should be shamed as well for engaging in it. I'm glad this practice is being exposed because last week's panic in the banking and mortgage-backed securities sector forced the SEC to ban naked short selling on 17 brokerage stocks along with Fannie Mae and Freddie Mac for 30 days.* (BTW, if you hold stock in either of those companies, get out now as their balance sheets are only going to get worse.) Former SEC Chairman Harvey Pitt was recently quoted as saying that he hopes the SEC will extend the ban to include all publicly traded stocks forever. Finally, a breath of sanity!

Anyway, enough from moi. Here's Professor Pat's explanation and take on the shocking practice of naked short selling.

Shenanigans Beyond Belief!

While watching CNBC the other day one of the commentators happened to mention the practice of naked short selling and how that might be affecting the downward trend of recent markets. I had heard the term before and never thought much about it but this time I wondered what exactly is the mechanism that is followed for such transactions.

Normal short selling is simple: The short seller borrows stock from someone who has agreed to loan them their stock. Since stock is being loaned, the seller agrees to pay interest on the value borrowed for the duration of the loan. The short seller then sells the shares on the open market and pockets the cash. Assuming the value of the shares have decreased at a later point in time, the seller buys back the shares on the open market. The stock is then returned to the lender and the interest on the borrowed amount is paid. The balance remaining is the profit from the short sale. This is all perfectly legitimate as everyone knows what is happening and they have agreed to it, or at least they should. If you have a brokerage account and you keep your shares there in what is called "street name," you have agreed to let the brokerage firm loan your shares to short sellers at their discretion. This is legitimate as you have been informed of and have consented to this practice as part of the account terms and agreement.

However, when someone or some institution practices naked short selling they are skipping the part where they first borrow the shares to sell. They are, in fact, selling something they don't have. Three days later at settlement time they have no stock to deliver unless they have borrowed the shares in the meantime. This is much like the kiting of checks where you rely on the clearing delays to create cash you don't actually have in your account. According to the SEC, naked shorting is perfectly legal unless the selling itself is done for the purpose of causing the price of a stock to drop rather than benefiting from a drop due to other reasons. Wikipedia quotes an "official with the SEC" saying that 1% of all dollar denominated trades (amounting to $1 billion every day) experience a settlement incident requiring additional time to complete, perhaps necessary for the stock to decline further for the short sale to become profitable at the expense of the buyer. This practice is even excused under the guise that it adds to market liquidity.

Now, let's say that I advertise to sell a used car and I find an out-of-town buyer who buys the car on the phone and sends me the cash for the car to reserve it. "I'll be by in three days to pick it up" he says. If I were to enter into such a transaction without ever actually having a car to sell I would be guilty of fraud and would go to jail. Selling something you don't own is usually a criminal act whether it be a used car or the Brooklyn Bridge. But when it comes to selling stock it's surprisingly not! Brokers do this kind of thing all the time and they don't have to go to jail.

There is no question that naked short selling is contributing to the current decline of the financial markets and therefore all our investment portfolios and 401K's. The brokerage houses are complicit in aiding and abetting this shady and dubious activity. Why do they do it you ask? Well, because they make money doing it that's why. They make money on every sell transaction and they make money on every buy transaction. For them, volume is what generates revenue. So, if a valued large client says they want to short naked they will likely go along for as long as the naked shorter is able to eventually deliver the promised sold stock and pay their brokerage commissions. The brokerage houses may even stand behind the short sale themselves making good on the transaction in the event of a default by the short seller. The brokerages can even keep this up, presumably within regulatory limits, as long as the eventual buyers of the stock do not demand to take physical delivery of their shares. Maybe we should all do that.

So, why sell naked instead of correctly borrowing the shares first? Well, maybe there are insufficient shares available to be borrowed. Or maybe a big advantage to the naked short sellers is the presumed absence of the interest charge that would normally be paid on the borrowed amount. Nothing borrowed, no interest cost.

In 1985 the SEC enacted Regulation SHO to combat abusive naked short selling. It has so many loopholes however that it may as well not exist. Market makers and brokerage houses are exempt from the rule. Brokerages also have immunity if the naked short selling client is "deemed" to own the stock they are selling. Yeah, right! While this nonsense is permitted here in the US one can only imagine the unbridled chicanery that goes on in relatively unregulated foreign markets.

So, what do we do about this? For now what I want is for all of you to get up out of your chairs and go to the window, open it and stick your head out and yell "I'm as mad as hell and I'm not going to take this anymore." ... with apologies to Peter Finch.**

-Written by SMCB Guest Contributor, Professor Pat

*What is so ironic is that the stock of the major brokerages are now exempt from naked shorting but the brokerage firms themselves are not exempt from doing it! To view the current SEC ruling regarding naked short selling and a list of those exempt from it, click on the following link:

http://www.sec.gov/news/press/2008/2008-143.htm

**If you'd like to do more than shout out the window, send a brief online note to the Senate Banking Committee. If you live in a state represented by a Banking Committee member, you can also contact that person. Here's the link to the Senate Banking Committee website (don't worry--it's easy to use and sending a note will only take a minute):

http://banking.senate.gov/public/index.cfm?FuseAction=Information.Membership

Anyway, enough from moi. Here's Professor Pat's explanation and take on the shocking practice of naked short selling.

Shenanigans Beyond Belief!

While watching CNBC the other day one of the commentators happened to mention the practice of naked short selling and how that might be affecting the downward trend of recent markets. I had heard the term before and never thought much about it but this time I wondered what exactly is the mechanism that is followed for such transactions.

Normal short selling is simple: The short seller borrows stock from someone who has agreed to loan them their stock. Since stock is being loaned, the seller agrees to pay interest on the value borrowed for the duration of the loan. The short seller then sells the shares on the open market and pockets the cash. Assuming the value of the shares have decreased at a later point in time, the seller buys back the shares on the open market. The stock is then returned to the lender and the interest on the borrowed amount is paid. The balance remaining is the profit from the short sale. This is all perfectly legitimate as everyone knows what is happening and they have agreed to it, or at least they should. If you have a brokerage account and you keep your shares there in what is called "street name," you have agreed to let the brokerage firm loan your shares to short sellers at their discretion. This is legitimate as you have been informed of and have consented to this practice as part of the account terms and agreement.

However, when someone or some institution practices naked short selling they are skipping the part where they first borrow the shares to sell. They are, in fact, selling something they don't have. Three days later at settlement time they have no stock to deliver unless they have borrowed the shares in the meantime. This is much like the kiting of checks where you rely on the clearing delays to create cash you don't actually have in your account. According to the SEC, naked shorting is perfectly legal unless the selling itself is done for the purpose of causing the price of a stock to drop rather than benefiting from a drop due to other reasons. Wikipedia quotes an "official with the SEC" saying that 1% of all dollar denominated trades (amounting to $1 billion every day) experience a settlement incident requiring additional time to complete, perhaps necessary for the stock to decline further for the short sale to become profitable at the expense of the buyer. This practice is even excused under the guise that it adds to market liquidity.

Now, let's say that I advertise to sell a used car and I find an out-of-town buyer who buys the car on the phone and sends me the cash for the car to reserve it. "I'll be by in three days to pick it up" he says. If I were to enter into such a transaction without ever actually having a car to sell I would be guilty of fraud and would go to jail. Selling something you don't own is usually a criminal act whether it be a used car or the Brooklyn Bridge. But when it comes to selling stock it's surprisingly not! Brokers do this kind of thing all the time and they don't have to go to jail.

There is no question that naked short selling is contributing to the current decline of the financial markets and therefore all our investment portfolios and 401K's. The brokerage houses are complicit in aiding and abetting this shady and dubious activity. Why do they do it you ask? Well, because they make money doing it that's why. They make money on every sell transaction and they make money on every buy transaction. For them, volume is what generates revenue. So, if a valued large client says they want to short naked they will likely go along for as long as the naked shorter is able to eventually deliver the promised sold stock and pay their brokerage commissions. The brokerage houses may even stand behind the short sale themselves making good on the transaction in the event of a default by the short seller. The brokerages can even keep this up, presumably within regulatory limits, as long as the eventual buyers of the stock do not demand to take physical delivery of their shares. Maybe we should all do that.

So, why sell naked instead of correctly borrowing the shares first? Well, maybe there are insufficient shares available to be borrowed. Or maybe a big advantage to the naked short sellers is the presumed absence of the interest charge that would normally be paid on the borrowed amount. Nothing borrowed, no interest cost.

In 1985 the SEC enacted Regulation SHO to combat abusive naked short selling. It has so many loopholes however that it may as well not exist. Market makers and brokerage houses are exempt from the rule. Brokerages also have immunity if the naked short selling client is "deemed" to own the stock they are selling. Yeah, right! While this nonsense is permitted here in the US one can only imagine the unbridled chicanery that goes on in relatively unregulated foreign markets.

So, what do we do about this? For now what I want is for all of you to get up out of your chairs and go to the window, open it and stick your head out and yell "I'm as mad as hell and I'm not going to take this anymore." ... with apologies to Peter Finch.**

-Written by SMCB Guest Contributor, Professor Pat

*What is so ironic is that the stock of the major brokerages are now exempt from naked shorting but the brokerage firms themselves are not exempt from doing it! To view the current SEC ruling regarding naked short selling and a list of those exempt from it, click on the following link:

http://www.sec.gov/news/press/2008/2008-143.htm

**If you'd like to do more than shout out the window, send a brief online note to the Senate Banking Committee. If you live in a state represented by a Banking Committee member, you can also contact that person. Here's the link to the Senate Banking Committee website (don't worry--it's easy to use and sending a note will only take a minute):

http://banking.senate.gov/public/index.cfm?FuseAction=Information.Membership

Note on Roche buyout of Genentech

It was announced earlier that Roche offered to buyout the rest of Genentech (DNA) stock that it didn't already own for a cash price amounting to $89 per share. In premarket trading, Genetech is currently being bid between $94 and $95. Why so high? Because the Street figures that $105 more accurately reflects the stock's worth. That amounts to roughly a 10% premium over the current price. It's a nice sum, but I'm not going to take the trade for my MANDA Fund because it's unclear as yet if Roche will meet that price, although they probably will. If they do, then I'll reconsider but for right now, it's too risky for my tastes.

Friday, July 18, 2008

Introducing MANDA

Yesterday we looked at established funds whose primary focus was buying M&A target stocks just after the acquisition announcement was made. I mentioned that Mario Gabelli, the manager of the Gabelli ABC Fund, has been doing this for 15 years. Although his year-to-date return is down -3.2%, he's never ended a year in the red. The fund's ten year average is a modest 6.7% but risk is minimal and best of all, the fund does quite well in bear markets. So why am I bringing this up again?

Being in a competitive mood, I thought “Hey, why don't I give Mario a run for his money?” So, I'm going to set up my own M&A fund to see if I can outperform the big guys. But what to call it? Well, after spending about three seconds on this I decided MANDA (M and A) would suffice. It's not the most clever title but it's one that I'll (hopefully) be able to remember.

The MANDA Fund set-up

The fund will open with $100,000 in capital. Trades will be entered on the target company at the first possible moment after the announcement is made. The majority of announcements are released when the market is closed, so those trades will be executed as soon as the market opens. (According to my broker, market-on-open orders are not guaranteed to be executed at the opening price.) If the announcement is made during market hours (which rarely happens), a trade will be entered as soon as possible as I'll need a few minutes to assess the deal. I'm allowing $10 as the trading fee which includes commissions ($9.95/trade) and regulatory costs which typically amount to only a few cents. No trade will be more than $10,000 or 10% of the total portfolio value. Account interest will be included at current rates and no margin will be used. As for terms, I'll be looking primarily at cash-only deals (no stock swaps), but if there's a compelling cash plus stock swap, I'll consider that, too. Evaluation will also be based on the terms of the deal: hostile takeovers and ones fraught with financial and/or regulatory issues may not make the cut. That's about it.

The first two trades

On July 10th, Dow Chemical (DOW) announced it will be buying Rohm Haas (ROH) for $78 in cash. The deal, partly financed by Warren Buffett and the government of Kuwait (Dow just sold its plastics division to Kuwait Petroleum), is expected to close sometime in early 2009. On the date of the announcement, Rohm stock opened at $73.80. I'm picking it up today for $74. The company just raised its dividend to $0.41/share. Beginning in 2002, the company has consistently paid quarterly dividends--February, May, August, and November. If I can collect two of those at the current price, that will give me a total gain of $4.82/share for a six-month return of 6.5% or 13% annually. Pretty good. Even if Rohm fails to pay a dividend, the six-month return will still be a decent 5.4% (10.8% annual return).

My other holding is Community Bankshares (SCB) which I highlighted in my June 26 blog. I bought that for my own portfolio on that day at $18.85/share and will be adding it here at that price. The expected six-month yield (including dividends) for SCB is 12.4%.

Current portfolio and future picks

When I find a compelling takeover candidate, I'll let you know on the day that I enter a trade. Current portfolio picks will be shown in the MANDA portfolio which will be located under Portfolios in the Blog Topic section to the right (as soon as I do a little layout rearranging).

Let's see if we can beat Mr. Gabelli's ABC Fund. Go MANDA!

Being in a competitive mood, I thought “Hey, why don't I give Mario a run for his money?” So, I'm going to set up my own M&A fund to see if I can outperform the big guys. But what to call it? Well, after spending about three seconds on this I decided MANDA (M and A) would suffice. It's not the most clever title but it's one that I'll (hopefully) be able to remember.

The MANDA Fund set-up

The fund will open with $100,000 in capital. Trades will be entered on the target company at the first possible moment after the announcement is made. The majority of announcements are released when the market is closed, so those trades will be executed as soon as the market opens. (According to my broker, market-on-open orders are not guaranteed to be executed at the opening price.) If the announcement is made during market hours (which rarely happens), a trade will be entered as soon as possible as I'll need a few minutes to assess the deal. I'm allowing $10 as the trading fee which includes commissions ($9.95/trade) and regulatory costs which typically amount to only a few cents. No trade will be more than $10,000 or 10% of the total portfolio value. Account interest will be included at current rates and no margin will be used. As for terms, I'll be looking primarily at cash-only deals (no stock swaps), but if there's a compelling cash plus stock swap, I'll consider that, too. Evaluation will also be based on the terms of the deal: hostile takeovers and ones fraught with financial and/or regulatory issues may not make the cut. That's about it.

The first two trades

On July 10th, Dow Chemical (DOW) announced it will be buying Rohm Haas (ROH) for $78 in cash. The deal, partly financed by Warren Buffett and the government of Kuwait (Dow just sold its plastics division to Kuwait Petroleum), is expected to close sometime in early 2009. On the date of the announcement, Rohm stock opened at $73.80. I'm picking it up today for $74. The company just raised its dividend to $0.41/share. Beginning in 2002, the company has consistently paid quarterly dividends--February, May, August, and November. If I can collect two of those at the current price, that will give me a total gain of $4.82/share for a six-month return of 6.5% or 13% annually. Pretty good. Even if Rohm fails to pay a dividend, the six-month return will still be a decent 5.4% (10.8% annual return).

My other holding is Community Bankshares (SCB) which I highlighted in my June 26 blog. I bought that for my own portfolio on that day at $18.85/share and will be adding it here at that price. The expected six-month yield (including dividends) for SCB is 12.4%.

Current portfolio and future picks

When I find a compelling takeover candidate, I'll let you know on the day that I enter a trade. Current portfolio picks will be shown in the MANDA portfolio which will be located under Portfolios in the Blog Topic section to the right (as soon as I do a little layout rearranging).

Let's see if we can beat Mr. Gabelli's ABC Fund. Go MANDA!

Thursday, July 17, 2008

M&A Funds

I mentioned before that putting out a daily blog is draining, especially one where I try to offer something original (it always is to me). Well, today is one of those days where the creative juices seem to be stalled. I'd rather be at the beach than tickling the keyboard ivories, but my conscience won't let me play hookey. So to come to a truce between the angel whispering in one ear and the devil in the other, I'm going to put in a short post today.

Post-take over Taco Funds

My last recipe (July 7) concerned itself with buying companies after a takeover was announced. I thought that was my own idea but Mario Gabelli beat me to it by only fifteen years. Apparently he has two funds that operate according to this strategy. The first is the Gabelli ABC Fund (GABCX), so named because the strategy is as easy as ABC. The second is the AXA Mergers & Acquisitions Fund (EMAAX) which has only been around since 2002. It's a bit riskier than the ABC because it can also invest in potential take-over targets. There are two other funds in this space (that I know of): the Merger Fund (MERFX) and the Arbitrage Fund (ARBFX). Compared with these two, the Gabelli Funds have the lower expense ratios combined with higher returns, although they do require a higher initial investment ($10,000 for the ABC Fund compared with $2000 for the Merger Fund). In fact, the ABC Fund has never had an unprofitable year.

The Upside

A major upside is that these funds outperform the S&P during bear markets. For example, in 2000 the ABC Fund returned 10.7% while the Vanguard Index 500 Fund (VFINX) that mirrors the S&P returned a dismal -9.1%. These funds have a bear market decile ranking of 1 which means that they outperform 90% of the fund universe in recessionary markets. Now these funds don't boast stellar returns (ten year average of the ABC Fund is 6.7%) but their other selling point is their low risk making them very safe investments.

The Downside

The downside to these funds is pretty obvious. The S&P clobbers them during bull markets. Also, a souring economy can stem the takeover tide. When M&A activity dries up, Gabelli stuffs fund cash into T-bills so at least the investor is getting that rate of return. However, the falling dollar hasn't stopped global M&A activity, with foreign companies eying the relatively cheap American valuations. (Witness InBev's recent takeover of Anheuser-Busch.)

All-in-all, if you don't know where to park your money and you want a better return than cash during bear markets, these funds could be for you. Based on fees and returns, the Gabelli ABC Fund would be my choice. If you have the time and would rather pick and choose your own stocks, review Recipe #13 as well as my April 29 and 30 blogs. For a current example, look at Community Bankshares (SCB) which I highlighted in the June 26 blog as potentially sporting a return of over 12% in six months (24% annual return).

There. I'm done. I hope the angel on my shoulder is satisfied 'cause I'm treating the little devil to an afternoon off.

Everyone needs the occasional day at the beach.

Post-take over Taco Funds

My last recipe (July 7) concerned itself with buying companies after a takeover was announced. I thought that was my own idea but Mario Gabelli beat me to it by only fifteen years. Apparently he has two funds that operate according to this strategy. The first is the Gabelli ABC Fund (GABCX), so named because the strategy is as easy as ABC. The second is the AXA Mergers & Acquisitions Fund (EMAAX) which has only been around since 2002. It's a bit riskier than the ABC because it can also invest in potential take-over targets. There are two other funds in this space (that I know of): the Merger Fund (MERFX) and the Arbitrage Fund (ARBFX). Compared with these two, the Gabelli Funds have the lower expense ratios combined with higher returns, although they do require a higher initial investment ($10,000 for the ABC Fund compared with $2000 for the Merger Fund). In fact, the ABC Fund has never had an unprofitable year.

The Upside

A major upside is that these funds outperform the S&P during bear markets. For example, in 2000 the ABC Fund returned 10.7% while the Vanguard Index 500 Fund (VFINX) that mirrors the S&P returned a dismal -9.1%. These funds have a bear market decile ranking of 1 which means that they outperform 90% of the fund universe in recessionary markets. Now these funds don't boast stellar returns (ten year average of the ABC Fund is 6.7%) but their other selling point is their low risk making them very safe investments.

The Downside

The downside to these funds is pretty obvious. The S&P clobbers them during bull markets. Also, a souring economy can stem the takeover tide. When M&A activity dries up, Gabelli stuffs fund cash into T-bills so at least the investor is getting that rate of return. However, the falling dollar hasn't stopped global M&A activity, with foreign companies eying the relatively cheap American valuations. (Witness InBev's recent takeover of Anheuser-Busch.)

All-in-all, if you don't know where to park your money and you want a better return than cash during bear markets, these funds could be for you. Based on fees and returns, the Gabelli ABC Fund would be my choice. If you have the time and would rather pick and choose your own stocks, review Recipe #13 as well as my April 29 and 30 blogs. For a current example, look at Community Bankshares (SCB) which I highlighted in the June 26 blog as potentially sporting a return of over 12% in six months (24% annual return).

There. I'm done. I hope the angel on my shoulder is satisfied 'cause I'm treating the little devil to an afternoon off.

Everyone needs the occasional day at the beach.

Wednesday, July 16, 2008

Chip Dip

A strange day in the market, what with the airlines, financials, and Detroit automakers all operating in the green. The other head-scratcher are the semis--the silicon chip variety as opposed to the trucking kind. Looking at the chip makers, there are very few that are in the red. What's going on here?

Well for starters, Intel late yesterday reported its second-quarter profit climbed 25 percent, helped by strong sales of laptop processors. The Street took this as a good sign for investors wary of possible slowing PC demand. An analyst at Deutsche Bank reiterated his Buy rating and set a $26 price target. Although the news was good, it didn't have a drastic effect on the stock which rose today by only 1%. In contrast, shares of Altera (ALTR) gapped up by over 12% this morning on news that its second-quarter income jumped almost 22% due to higher sales and improved margins. Comparing the two charts, Altera's is much more exciting than Intel's, and that would be my pick of two. The chart shows resistance at $24 which is 10% above its current $21.65 price.

My Chip Pix

It's the general consensus of industry analysts that the chip makers will fare much better in the second half of this year, the only caveat being that the consumer can't close her pocketbook. In the past, computer sales were driven by corporate infrastructure; now, sales are much more consumer dependent. There's been plenty of jawing recently about which chip makers will fare the best based on fundamentals. If you're interested in getting in on this sector (and now could be an excellent time), I'll leave fundamental analysis to you. Besides, you should be doing this type of research anyway. Listen to Cramer!

Okay. I'll stop shaking my finger. Based purely on chartology, here are my candidates for Technical Best of Breed (TBB).

The Blue Ribbon Winners

Altera (ALTR) is my top chip choice and frankly there aren't a whole lot of dazzling candidates, at least for now. But things are starting to look up. Broadcom (BRCM) has recovered nicely from its multi-year low, gaining over 75% since March. It's been range-bound for the past several months and is nudging up against major resistance at $30. It reports earnings after the bell on July 22nd and if investors like what they hear, a jump above $30 could make for clear sailing to the next resistance level at $36.

The Runners-up

The following aren't my top choices, but they're performing well in the “Sporting Compelling Charts” category. Included are their current prices, expected earnings dates, and earnings estimates. (A denotes after-the-bell and U is unconfirmed.)

Flextronics (FLEX): $9.20. Earnings 7/24. Earnings estimate: $0.28

Skyworks (SWKS): $10.30. Earnings 7/17 A. Earnings estimate: $0.17

National Semi (NSM): $21.30. Earnings 9/5. Earnings estimate: $0.34

QLogic (QLGC): $16.30. Earnings 7/21 A. Earnings estimate: $0.29

SatCon Technologies (SATC): $2.80. Earnings 8/04 U. Earnings estimate: -$0.07

Silicon Storage (SSTI): $3.20. Earnings 7/29. Earnings estimate: -$0.09

Sun Chips

I can't conclude a discussion of the semis without at least paying lip service to the solar guys.This group has gotten bruised along with their less exotic brethren, but even they too are starting to turn up. If you like channeling stocks, look at Evergreen Solar (ESLR) and First Solar (FSLR). Rangebound as they have been, if this group does well, expect them to break overhead resistance. Trina Solar (TSL) jumped by a whopping 12% today off major support. Other stocks with bullishly biased charts are JA Solar (JASO), SunPower (SPWR), and LDK Solar (LDK).

Other ways to dip into chips

If you're still a tad wary of picking individual stocks you can buy the SMH which is the Semiconductor ETF. The stock is bouncing off $28 major support and could be heading back towards resistance at $34. Another way to play it involves options. Yes, I know you might not want to risk playing options in this sector because who knows? If the Grinch steals Christmas this year, chip profits will definitely suffer (along with everyone else's). But there is a way to cover your butt and your profits. Assuming the stock in question is optionable, you can purchase calls on the stock and simultaneously buy puts on the SMH. The SMH puts are your hedge against downside risk.

Conclusion

As I said, I don't know if the chips are going to amount to more than a hill of beans in the upcoming months, but if they do, now is the time to get in on the action. Remember, if you're heavily weighted in only a few sectors, it's always a good idea to diversify your holdings especially when a promising opportunity arises. Considering today's winning sectors, I'd much rather risk diversifying into the chips than into the airlines, financials, or auto makers. (I do think, though, that when we can see the clouds clearing over the credit crisis that financials will be looking mighty attractive, but I don't think right now is the right time.)

Note on today's market action: Although the market seems like it put in a bottom yesterday, I believe this to be another bear trap. I think we need complete capitulation before a true reversal can take place and that won't happen until the VIX hits the 35 mark. That's my tune and I'm stickin' to it!

Well for starters, Intel late yesterday reported its second-quarter profit climbed 25 percent, helped by strong sales of laptop processors. The Street took this as a good sign for investors wary of possible slowing PC demand. An analyst at Deutsche Bank reiterated his Buy rating and set a $26 price target. Although the news was good, it didn't have a drastic effect on the stock which rose today by only 1%. In contrast, shares of Altera (ALTR) gapped up by over 12% this morning on news that its second-quarter income jumped almost 22% due to higher sales and improved margins. Comparing the two charts, Altera's is much more exciting than Intel's, and that would be my pick of two. The chart shows resistance at $24 which is 10% above its current $21.65 price.

My Chip Pix

It's the general consensus of industry analysts that the chip makers will fare much better in the second half of this year, the only caveat being that the consumer can't close her pocketbook. In the past, computer sales were driven by corporate infrastructure; now, sales are much more consumer dependent. There's been plenty of jawing recently about which chip makers will fare the best based on fundamentals. If you're interested in getting in on this sector (and now could be an excellent time), I'll leave fundamental analysis to you. Besides, you should be doing this type of research anyway. Listen to Cramer!

Okay. I'll stop shaking my finger. Based purely on chartology, here are my candidates for Technical Best of Breed (TBB).

The Blue Ribbon Winners

Altera (ALTR) is my top chip choice and frankly there aren't a whole lot of dazzling candidates, at least for now. But things are starting to look up. Broadcom (BRCM) has recovered nicely from its multi-year low, gaining over 75% since March. It's been range-bound for the past several months and is nudging up against major resistance at $30. It reports earnings after the bell on July 22nd and if investors like what they hear, a jump above $30 could make for clear sailing to the next resistance level at $36.

The Runners-up

The following aren't my top choices, but they're performing well in the “Sporting Compelling Charts” category. Included are their current prices, expected earnings dates, and earnings estimates. (A denotes after-the-bell and U is unconfirmed.)

Flextronics (FLEX): $9.20. Earnings 7/24. Earnings estimate: $0.28

Skyworks (SWKS): $10.30. Earnings 7/17 A. Earnings estimate: $0.17

National Semi (NSM): $21.30. Earnings 9/5. Earnings estimate: $0.34

QLogic (QLGC): $16.30. Earnings 7/21 A. Earnings estimate: $0.29

SatCon Technologies (SATC): $2.80. Earnings 8/04 U. Earnings estimate: -$0.07

Silicon Storage (SSTI): $3.20. Earnings 7/29. Earnings estimate: -$0.09

Sun Chips

I can't conclude a discussion of the semis without at least paying lip service to the solar guys.This group has gotten bruised along with their less exotic brethren, but even they too are starting to turn up. If you like channeling stocks, look at Evergreen Solar (ESLR) and First Solar (FSLR). Rangebound as they have been, if this group does well, expect them to break overhead resistance. Trina Solar (TSL) jumped by a whopping 12% today off major support. Other stocks with bullishly biased charts are JA Solar (JASO), SunPower (SPWR), and LDK Solar (LDK).

Other ways to dip into chips

If you're still a tad wary of picking individual stocks you can buy the SMH which is the Semiconductor ETF. The stock is bouncing off $28 major support and could be heading back towards resistance at $34. Another way to play it involves options. Yes, I know you might not want to risk playing options in this sector because who knows? If the Grinch steals Christmas this year, chip profits will definitely suffer (along with everyone else's). But there is a way to cover your butt and your profits. Assuming the stock in question is optionable, you can purchase calls on the stock and simultaneously buy puts on the SMH. The SMH puts are your hedge against downside risk.

Conclusion

As I said, I don't know if the chips are going to amount to more than a hill of beans in the upcoming months, but if they do, now is the time to get in on the action. Remember, if you're heavily weighted in only a few sectors, it's always a good idea to diversify your holdings especially when a promising opportunity arises. Considering today's winning sectors, I'd much rather risk diversifying into the chips than into the airlines, financials, or auto makers. (I do think, though, that when we can see the clouds clearing over the credit crisis that financials will be looking mighty attractive, but I don't think right now is the right time.)

Note on today's market action: Although the market seems like it put in a bottom yesterday, I believe this to be another bear trap. I think we need complete capitulation before a true reversal can take place and that won't happen until the VIX hits the 35 mark. That's my tune and I'm stickin' to it!

Tuesday, July 15, 2008

VIX Plays

Yesterday we delved into the mysteries of the VIX looking at it from an historical perspective and what it portends for the market. I also tossed in my two cents concerning ways to play the market when the VIX hits various levels, saying that a rise above 30 generally signals that a market turnaround (even if it's a short-lived one) is imminent. Well, earlier this morning the VIX did rise above 30. As of this writing (about an hour before market close), the major market indices look to be forming bottoming tails--another tell-tale signal of market reversal. So, the question of the day is: how can we make a quick buck from a market reversal? Let's review some of our options.

The Set-Up